How The 2017 Tax Reforms Impact University Donations

How do the tax reforms impact your donors?

Thanksgiving marks the beginning of the alumni giving season, kicking off with Giving Tuesday which this year falls on December 3. According to Giving USA, approximately 30% of annual giving occurs in December. Time to dust off last year’s end-of-year fundraising plan. Or not.

Every plan needs to be assessed on a regular basis to confirm that it is leading to the expected results. A key part of that assessment is reviewing the plan’s underlying assumptions. Unfortunately, many institutions fail to take this step and rely upon their traditional practices in hopes that it will work one year more. With the multitude of changes the U.S. has experienced over the last decade, many colleges and universities could benefit from taking a personal inventory of their year-end plans and making the necessary changes to fit the current environment.

One major change to the current fundraising environment is the 2017 tax reforms. Because the standard deduction doubled to $12,000 for individuals and $24,000 for married couples, far fewer Americans will be able to deduct their charitable giving on their tax filings. Being able to claim a tax deduction is one of many factors that drive alumni giving behavior. As stated by Una Osili of the Lilly Family School of Philanthropy, “Taxes are not the reason people give, but they affect the timing, the amount and sometimes the vehicles donors use to make those gifts.”

Recent data confirms this as shortly after the reforms were enacted, the American Enterprise Institute and the Tax Policy Center predicted that donations would decrease by approximately $12-20 billion in 2018. These fears were well-founded as, according to Giving USA, individual giving dropped 3.4% in 2018 (adjusted for inflation). This was the first decline in individual giving since 2013, and a major reversal from the 5.7% increase in individual giving seen in 2017.

The 2018 decline in individual giving may portend further challenges for fundraisers as the tax changes become more widely understood. IRS data from the first half of 2019 shows that 11 million taxpayers itemized charitable deductions compared to 31 million during the same period in 2018. Some may take comfort in the fact that while the number of taxpayers still itemizing their deductions fell by 66%, the number of contributions “only” declined by 33% ($54 billion).

But only a small minority of colleges and universities have large enough endowments that they can brush off a decline in individual giving. For most institutions any decrease in alumni giving means fewer scholarships for deserving students, improvements to student facilities postponed, staff pay rises deferred, and so on. This makes it even more important to re-evaluate what plans are in place to drive up giving in order to reverse the cycle experienced from the tax changes.

Universities are being confronted by a perfect storm of fundraising headwinds. Participation rates have been declining consistently for decades, endowment returns are predicted to be lower over the next decade, and there is a generational change in attitudes towards giving with millennials preferring to give to causes rather than institutions. The list goes on.

Enough of the doom and gloom. What can a fundraiser do to weather the storm? Wait it out perhaps? As with most statistics, it’s important to dive deeper into the numbers. According to the Tax Policy Center, the loss of the charitable deduction does not really affect high-giving donors because they typically still itemize their charitable contributions. In fact, some major donors have actually donated more since the tax changes took effect. Wealthy alumni are able to take advantage of sophisticated tax-saving structures such as Donor Advised Funds (DAF). Donors that are aged 70 1/2 and older also have the ability to support their favorite charities while lowering their tax bill by using a qualified charitable distribution (QCD) from their IRA.

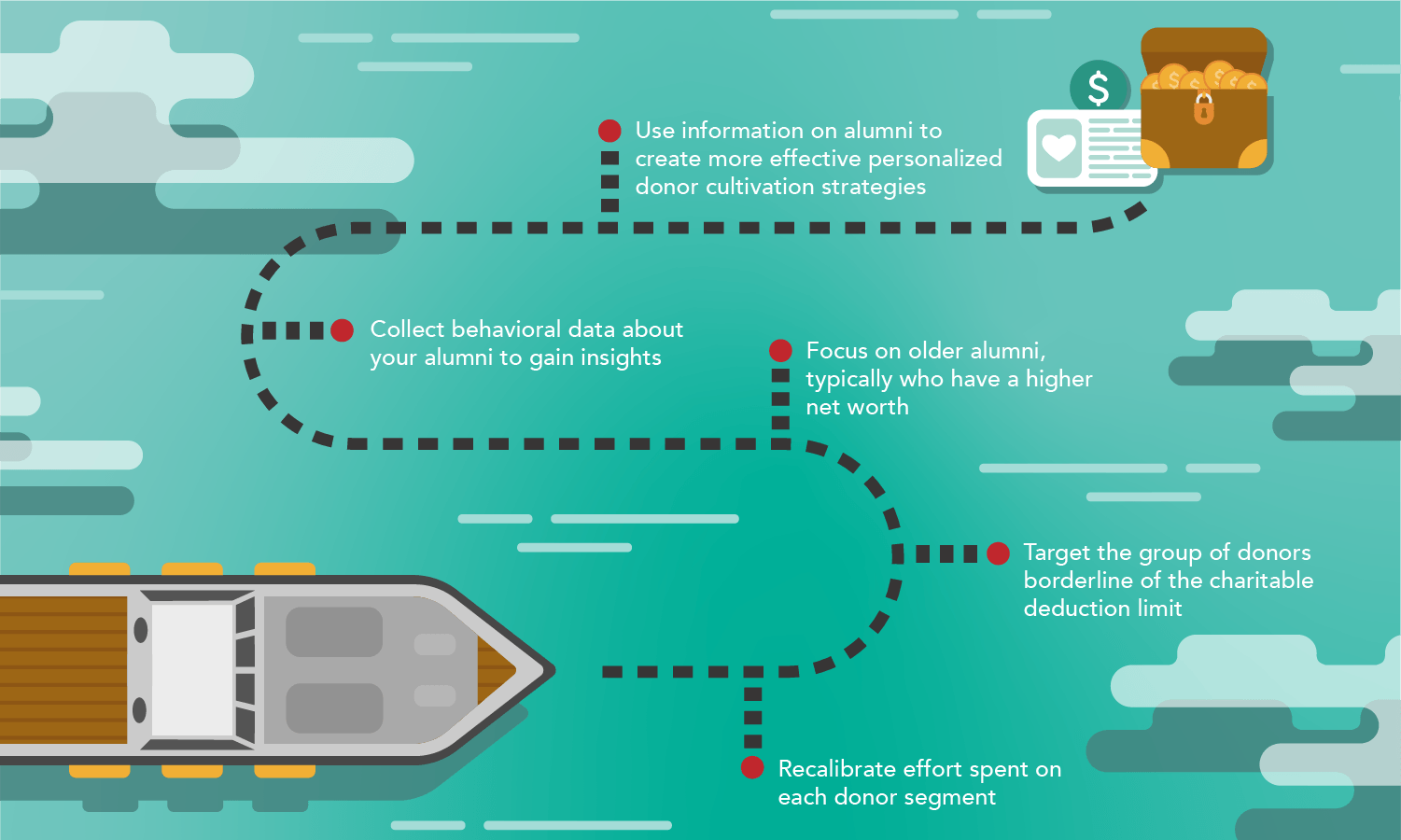

In summary, the tax reforms impact donor segments differently, particularly as segmented by age and capacity to give. Knowing this, universities should recalibrate the effort they expend on each donor segment. Steve Taylor, a Senior Vice President at the United Way, one of America’s largest charities, has said that his organization may have to focus more attention on wealthy donors because of the reduced incentive for moderate-income taxpayers.

Universities should also target the group that is on the borderline of the itemized charitable deduction limit. Donors who give in the $1,000 to $10,000 range will require additional focus by gift officers to nudge them over the threshold. “Institutions need to begin providing more stewardship to leadership annual donors,” says Travis McDearmon, Development Officer at Butler University. “This is the group that will both make up the losses we are seeing as a result of tax reforms and also be the next generation of major donors that will fill our pipelines.” Donors at this level are generally mid-career and juggling many things like mortgages, lifestyle expenses, and even tuition. However, McDearmon believes that by showing appreciation for their support now, will pay dividends in the future.

Its time to get creative. One idea when targeting mid-tier donors is to explain to them the benefits of a DAF. They are not just tax-efficient vehicles for your top-tier donors. Your mid-tier donors can also take advantage of a DAF to group several years’ worth of giving into one year. This may provide just the incentive for them to donate now rather than later. For example, if a donor generally gives $5,000 each year which falls under the $12,000 standard deduction, you can suggest that they gift three years or more into a DAF all in one year, this way they have $5,000 distributed from the DAF each year. With this, your donor benefits because they can now claim the $15,000 deduction. And the university benefits by locking in three years' worth of donations. A win-win for everyone.

Wealthy donors (that is, the ones who will still itemize) are typically going to be older. Intuitively, we all know that the high net worth alumni are almost certainly a baby boomer, not a millennial. Doubling-down on older alumni will lead to a greater return on effort compared to any other donor segment. When storm clouds appear on the horizon it is prudent to harvest as much as one can while the sun is still shining.

If your target is clear, what strategies can be employed to increase the likelihood that your alumni will support your mission regardless of how turbulent the waters are? Collecting behavioral data about your alumni provides insight into their interests and connections: what they care about, who they care about, why they care, how your university shaped their career, which staff impacted their life, and so on. Armed with such information, your gift officers can then create more effective personalized donor cultivation strategies.

Countering the current headwinds will also require gift officers to familiarize themselves with the various tax vehicles that certain donors can take advantage of. Blindly asking for a cash donation will not yield the same results as in the past and may lead to lots of money left on the table. Today’s gift officer needs to keep up-to-date with DAFs, the impact of the Pease Limitation elimination, changes to athletic event deductions, the increase in the estate-tax exemption, and so on.

Knowing how to tack when the winds of change blow unfavorably is crucial to success. Sure, the new tax laws have diminished the incentives for small donations, leading to fewer contributions by lower-touch alumni. But, fortunately, you still have a source of high-value donors less affected by these changes including baby-boomers and your leadership annual population. Armed with this knowledge, a more creative, flexible end-of-year plan will find ways to successfully navigate today’s stormy waters.

Stay ahead of the curve with CueBack

The world of advancement is changing. Don’t get left behind. Stay ahead of the curve with insights from forward thinkers in the industry who are paving the way for tomorrow’s advancement professional leaders.